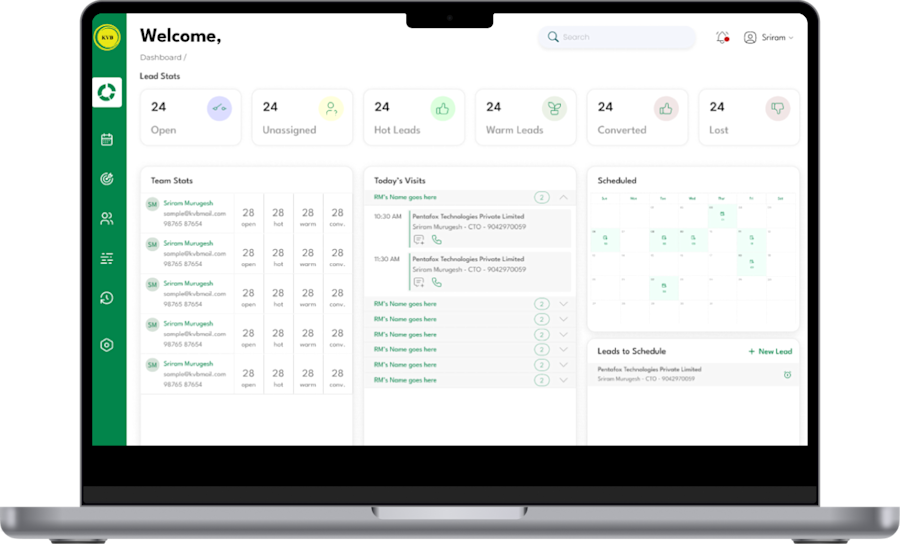

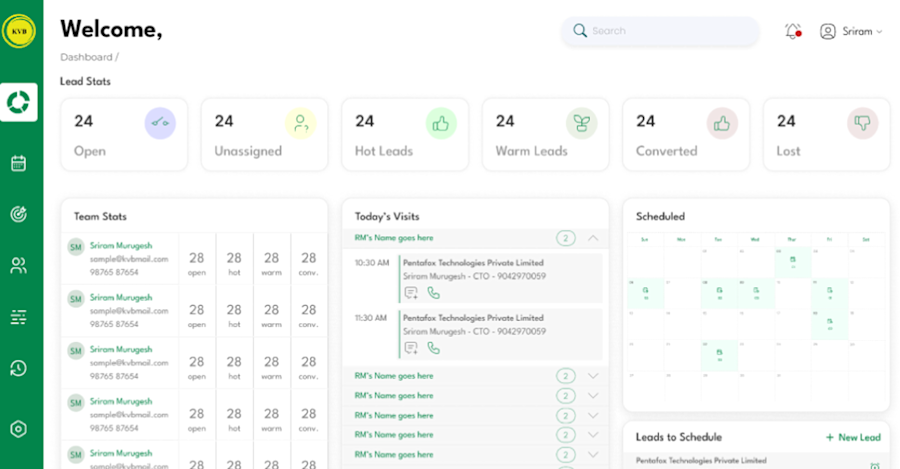

Pentafox Digitizes Lead Management with KVB-LMS

See how Pentafox centralized lead management to enable faster follow-ups and better customer conversion.

Background & Story

KVB-LMS (Lead Management System) is a web and tablet-based application developed for the banking sector to streamline the management of customer (leads). In banks, a lead refers to a potential customer who has shown interest in purchasing a loan. Before the implementation of KVB-LMS, banking staff relied on manual processes and fragmented systems to record, track, and follow up on Customers (leads). This approach often resulted in inconsistent data, delayed follow-ups, difficulty in tracking lead status, and reduced conversion efficiency. To address these challenges, KVB-LMS was designed as a centralized digital platform that allows bank employees to capture, update, and manage lead information efficiently through both web and tablet applications. The system enables staff to maintain complete customer details, monitor lead progress, and ensure timely follow-ups, thereby improving operational efficiency and customer experience. The project focuses on providing a secure, user-friendly, and reliable solution that supports banking staff in managing high volumes of leads while maintaining data accuracy and compliance with banking standards.

Technology Stack

Mission

To build a centralized Lead Management System that enables banking staff to efficiently capture, manage, and track leads through web and tablet applications.

To replace manual and fragmented workflows with a secure, user-friendly digital solution for effective lead management.

To ensure accurate and consistent maintenance of customer details, reducing errors in lead and loan processing.

To support timely follow-ups and improved lead tracking, helping banking teams increase conversion rates.

To deliver a scalable, reliable, and compliant system that enhances staff productivity while meeting banking operational standards.

Goals

To build a centralized and scalable Lead Management System that allows banking staff to efficiently access, update, and manage leads details through web and tablet applications.

To streamline lead capture, tracking, and follow-up processes by reducing manual effort, ensuring accurate and consistent customer data across the lead lifecycle.

To provide clear visibility into lead status and progress while ensuring system security, compliance, and support for informed decision-making by banking teams.

Challenges

Data Accuracy & Consistency

Managing and maintaining accurate customer and lead data across both web and tablet applications while avoiding data duplication and inconsistencies.

Real-Time Lead Updates

Handling frequent changes in lead status and ensuring real-time visibility for banking staff working from different locations.

Security & Compliance

Ensuring secure access to the application and protecting sensitive customer data in compliance with banking standards while maintaining ease of use.

Tablet Performance & Network Issues

Supporting smooth performance and usability on tablet devices used for field operations, including handling network fluctuations.

Multi-Platform Testing & Validation

Coordinating testing and validation across multiple platforms and workflows to ensure reliable end-to-end lead management.

Solution & Strategy

KVB-LMS introduced a centralized digital platform that streamlined loan lead management across web and tablet applications

Centralized lead and customer data management replacing manual and fragmented tracking methods.

Role-based access control to ensure secure usage by banking staff based on their responsibilities.

Real-time lead status updates to enable timely follow-ups and improved lead visibility.

Optimized workflows for lead creation, updates, and follow-up activities with clear status tracking.

Cross-platform support ensuring smooth performance and usability for both branch and field staff.

Collaboration

KVB-LMS was developed with active input from banking stakeholders, branch staff, and the project team. Real operational requirements shaped lead workflows, access permissions, and data management features. Continuous feedback from end users helped align the platform with banking standards while improving usability, efficiency, and lead conversion outcomes.

Impact & Results

Fully digital lead management process across web and tablet applications.

Reduced manual errors and elimination of paper-based lead tracking.

Clear visibility into lead history, status updates, and follow-up activities

Faster communication and timely actions through real-time lead updates.

Improved compliance with banking processes and data-handling standards.

Conclusion

KVB-LMS successfully transformed the way loan leads are managed within the banking environment by introducing a centralized, secure, and user-friendly digital platform. By replacing manual processes with streamlined web and tablet workflows, the system improved data accuracy, lead visibility, and operational efficiency. Overall, the project delivered a reliable solution that supports banking staff in managing leads effectively while aligning with industry standards and business goals.

Read Our Other Products

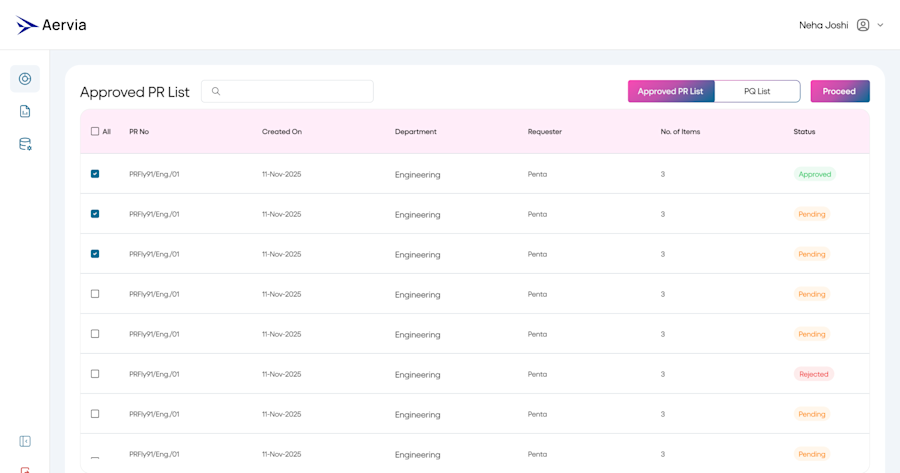

Pentafox Digitizes End-to-End Procurement Workflows with the Procure360 Platform

See how Pentafox replaced fragmented email and spreadsheet procurement with a centralized platform that simplifies purchase requests, approvals, and process control.

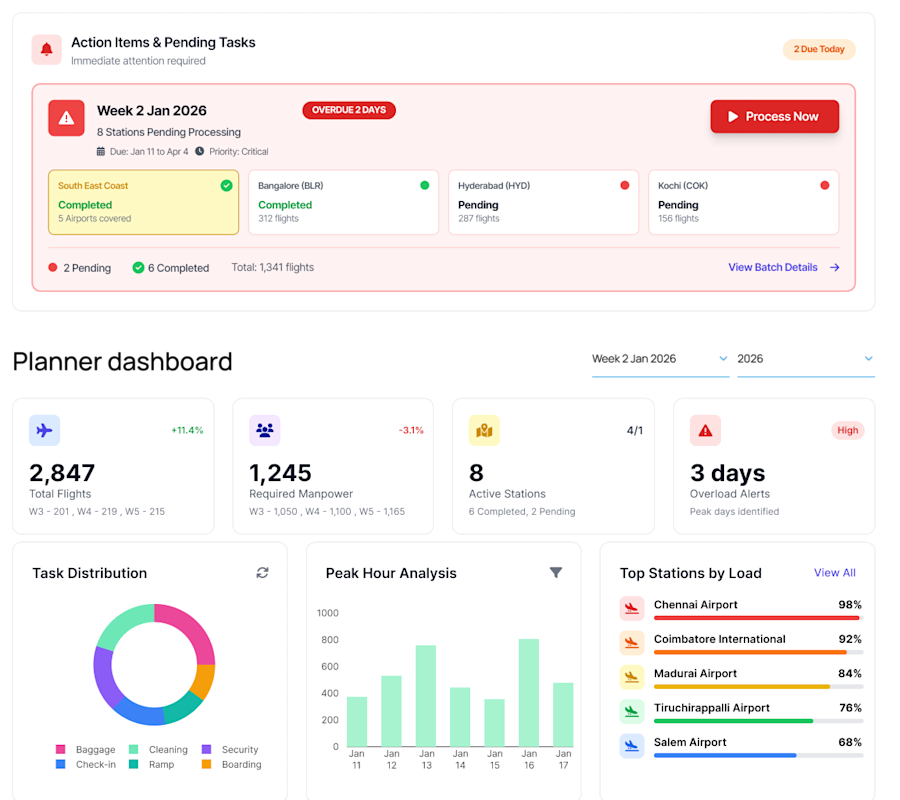

Pentafox Digitizes Workforce Planning with the WFM Platform for Aviation Operations

See how Pentafox leverages AI/ML to intelligently plan, allocate, and monitor airline manpower through automated workforce scheduling and real-time visibility—improving staffing visibility, operational efficiency, and regulatory compliance.

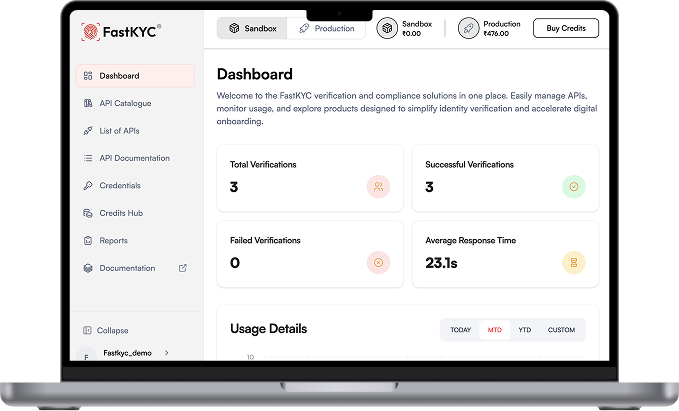

FastKYC – API-Driven Identity Verification Platform

A secure, high-performance KYC verification platform built entirely on APIs to accelerate onboarding, strengthen compliance, and eliminate manual verification processes.

WALANE – Unified Customer Engagement

WALANE transforms business communication by unifying sales, support, and marketing into a single messaging-led ecosystem, built on the world’s most used channels.

FinTech Loan Origination System – API Integration & Route Manager

A configurable API route manager designed to accelerate loan origination by enabling seamless, plug-and-play integration with external financial services across the BFSI ecosystem.

PetroMoney App – Digital Lending Platform for Fuel Retailers

A scalable, mobile-first digital lending platform that enables fast, customized financing for fuel station owners, transforming petrol stations into digitally empowered commercial hubs.

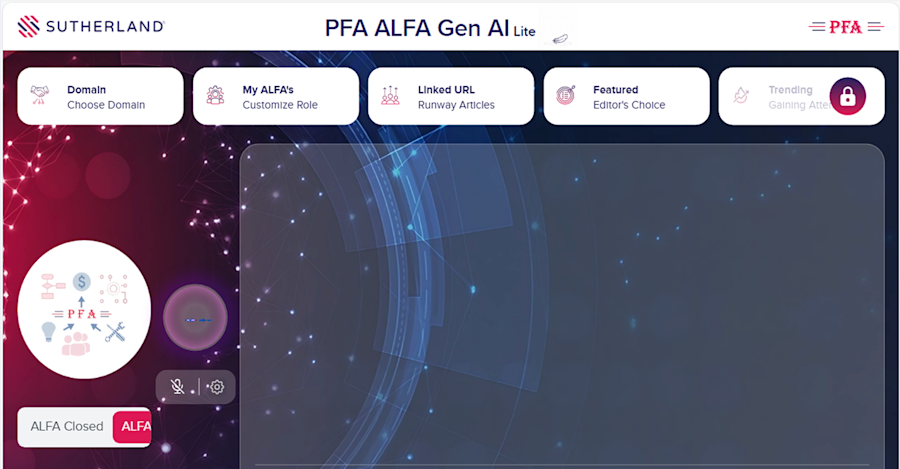

Sutherland ALFA Lite – AI-Powered Chatbot

An AI-driven business analytics chatbot platform that makes enterprise data accessible and actionable through natural language, voice commands, and document-based insights.

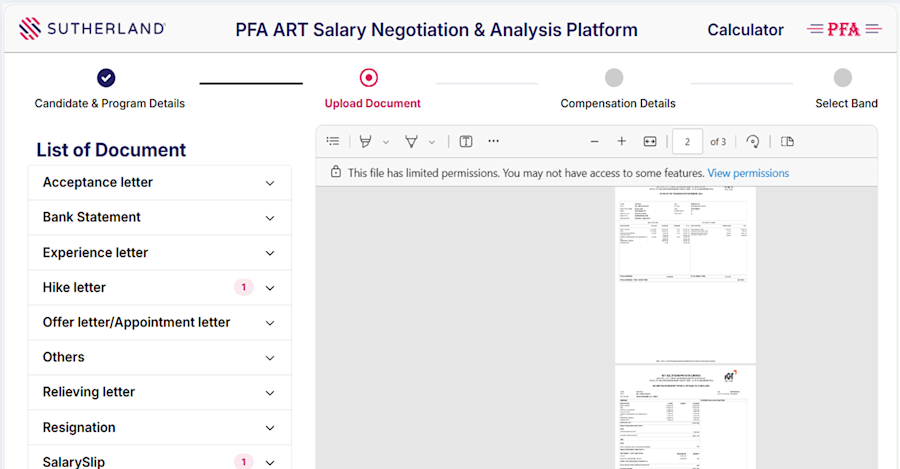

ALFA SNAP – Intelligent Document Analytics

SNAP (Salary Negotiation Automation Platform) is an AI-driven web-based solution that automates salary document analysis and negotiation workflows.

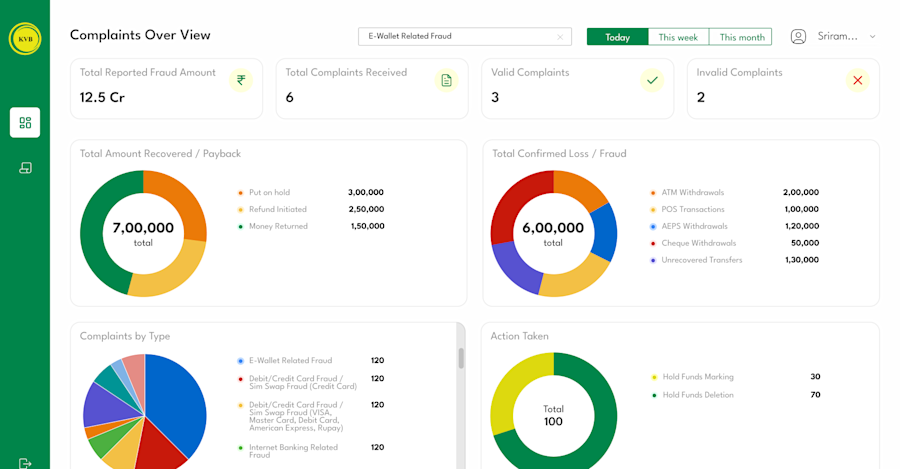

Pentafox Digitizes Cybercrime Complaint Processing with NCRP Digital Web Application

See how Pentafox digitized cybercrime complaint processing to enable faster, secure, and compliant financial fraud response.

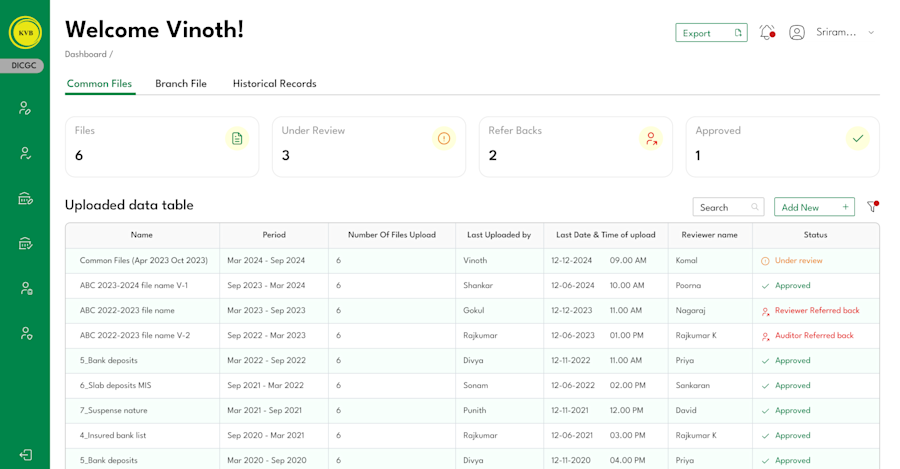

Pentafox Centralizes DICGC Premium Filing with a Digital Platform

See how Pentafox digitized DICGC premium computation and filings to ensure accurate, compliant, and audit-ready reporting.

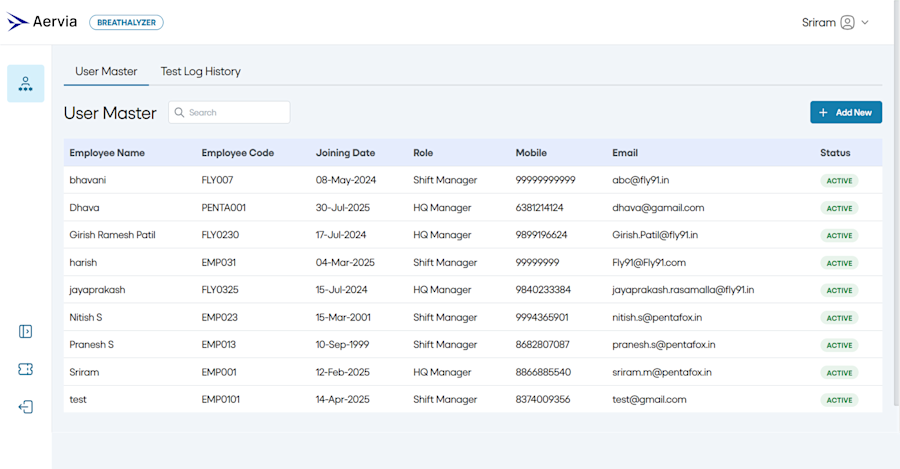

Pentafox Digitizes Alcohol Testing Compliance with the Breathalyzer Platform for Aviation Operations

See how Pentafox digitized alcohol testing for aviation and ground teams to improve accuracy, compliance, visibility, and operational efficiency.

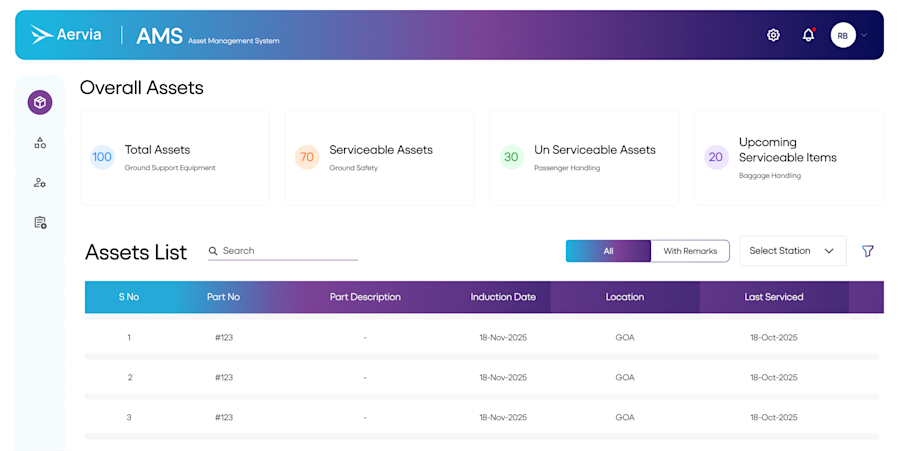

Pentafox Digitizes Ground Operations Asset Management with the AMS Platform for Airline Operations

See how Pentafox digitized procurement processes to improve control and transparency.

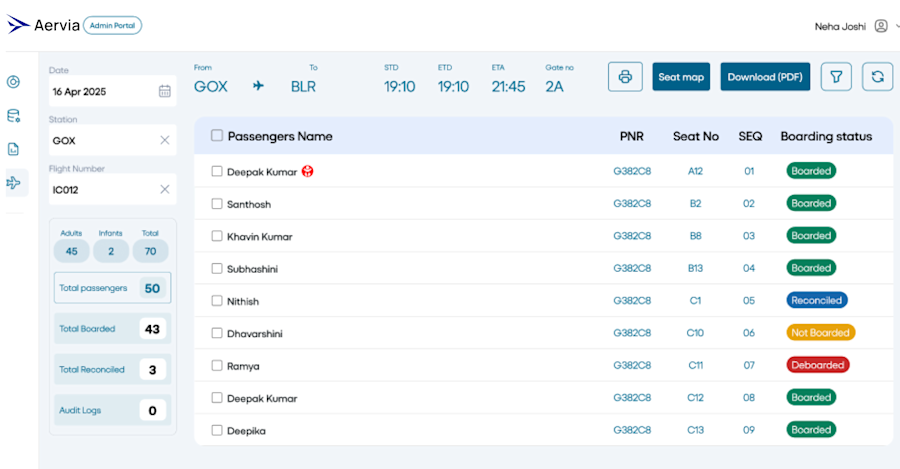

Pentafox Digitizes Passenger Boarding and Reconciliation with the PRS Platform

See how Pentafox enabled post-booking meal selection through automated WhatsApp workflows.

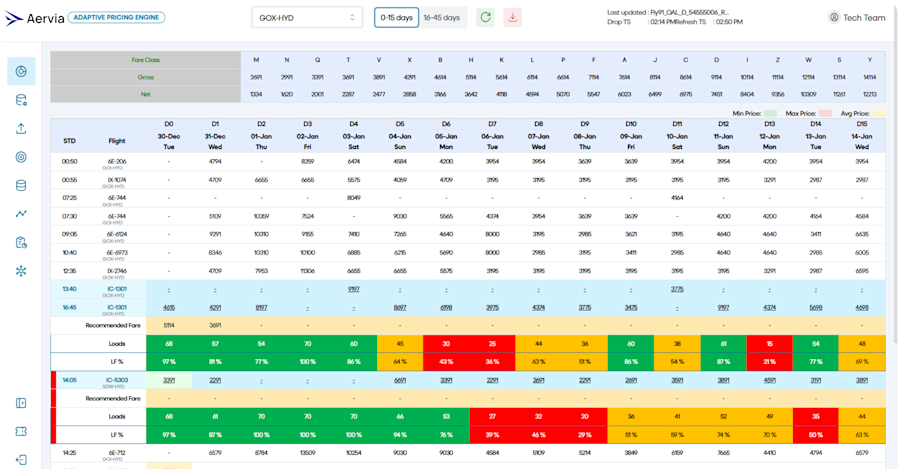

Pentafox Automates Competitive Fare Analysis and Pricing Decisions with the Pricing Portal Platform

See how Pentafox unified flight operations data to improve coordination and regulatory compliance.

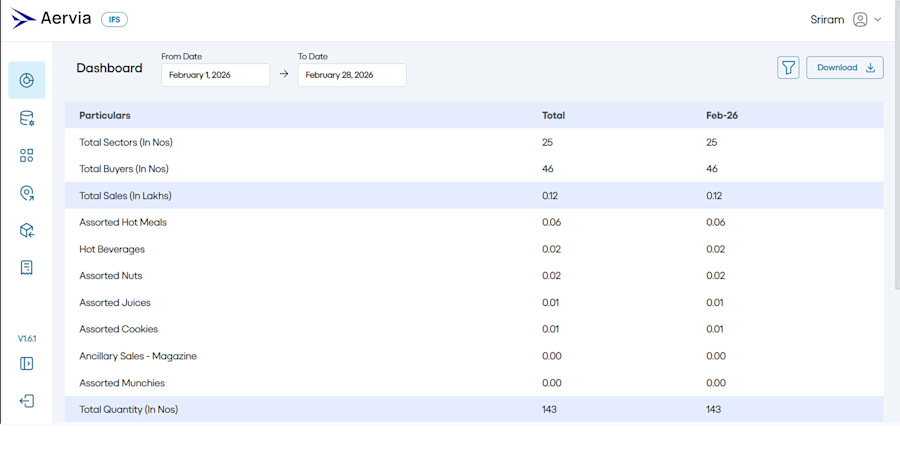

Pentafox Digitizes In-Flight Sales and Operations with the IFS Platform

See how Pentafox digitized boarding and reconciliation to reduce delays and eliminate errors.

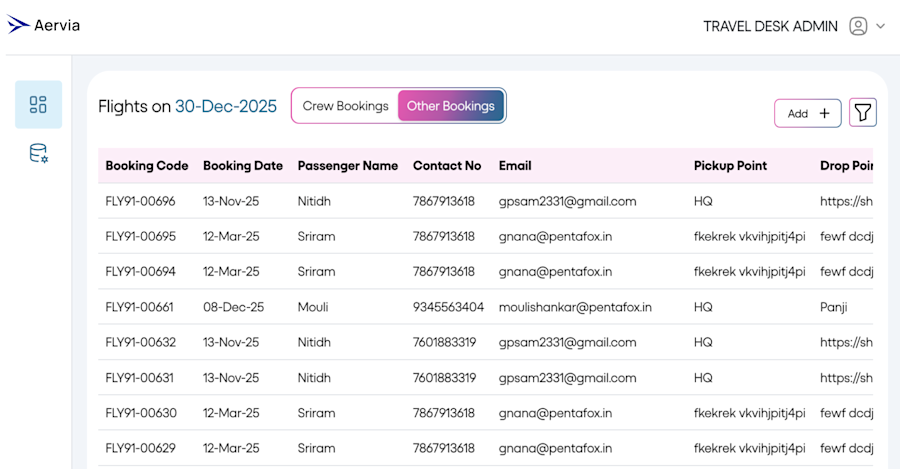

Pentafox Streamlines Crew Cab Booking and Journey Management with the Enroute Platform

See how Pentafox digitized airline fare analysis to enable faster, more accurate pricing decisions.

Pentafox Enhances Passenger Communication by Integrating Booking Contact Data with DCS Through the Guest Bridge Platform

See how Pentafox streamlined post-booking meal selection to improve convenience and ancillary revenue.

WhatsApp Meal Booking System — Meal Booking via WhatsApp Bot

See how Pentafox improved airline operational communication without modifying core DCS systems.

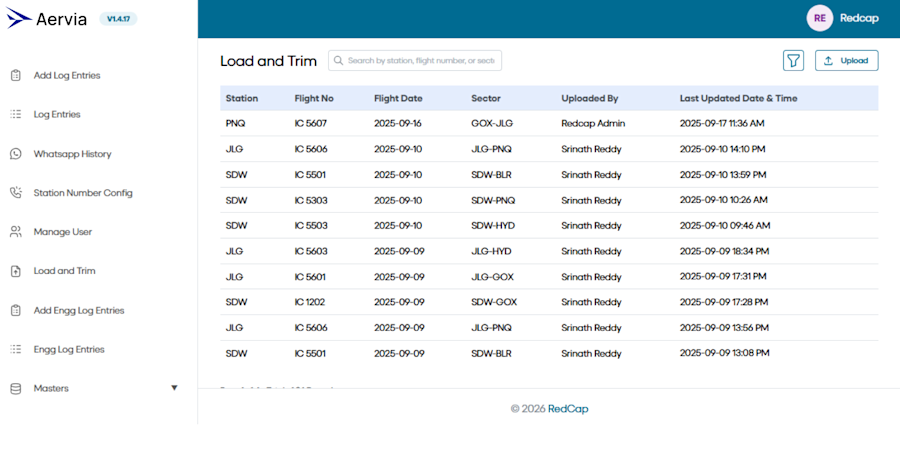

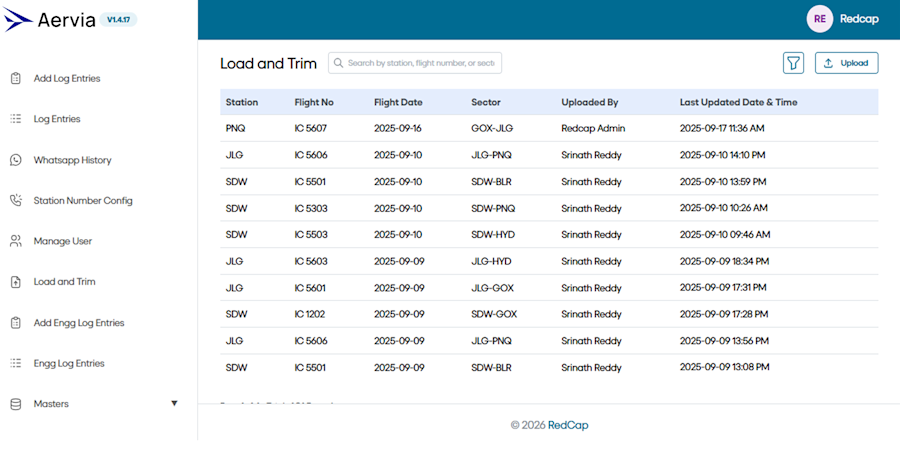

Pentafox Centralizes Flight Operations Management with the RedCap Platform

See how Pentafox digitized asset tracking for ground operations to improve safety, compliance, and efficiency.

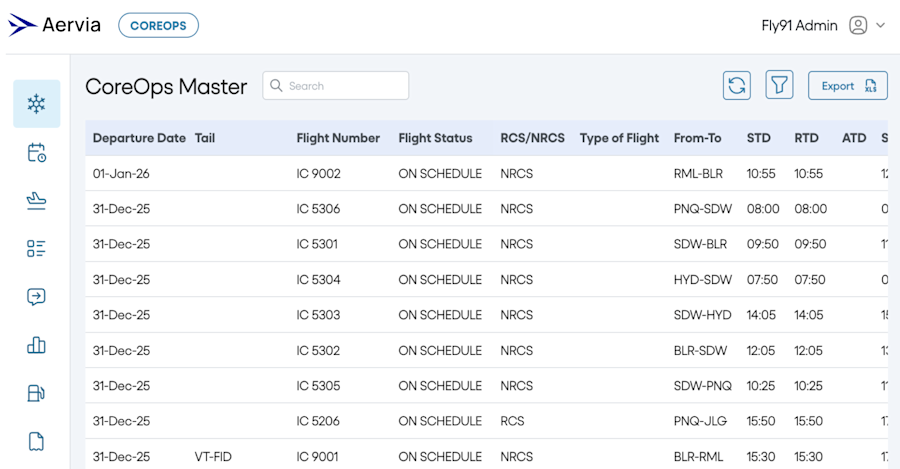

Pentafox Centralizes Airline Flight Operations Monitoring with the CoreOps Platform

See how Pentafox unified airline operational data to deliver real-time visibility and improved operational control.

Digital Suite for MLOps

An advanced Digital Suite for MLOps that streamlines machine learning workflows, enhances collaboration, and enables scalable, production-ready ML operations.

Suraaj Consultants – Custom Route Manager Suite

A custom-built Route Manager Suite designed to handle large-scale external API integrations, enabling seamless configuration, deployment, and consumption of third-party services within a BFSI financial platform.

Automobile Customer 360 – Data Engineering Platform

A robust data engineering platform that cleanses, enriches, and unifies automotive customer data across multiple formats and systems to deliver accurate Customer 360 views.

Application Migration – Azure Service Fabric to EKS & AKS

An application modernization initiative that migrated enterprise workloads from Azure Service Fabric to Kubernetes on Amazon EKS and Azure AKS, enabling scalability, resilience, and operational flexibility.

iRCA – Intelligent Root Cause Analysis Bot

An intelligent Root Cause Analysis (RCA) bot that proactively monitors production environments, detects anomalies, identifies root causes, and automates incident documentation and communication.

Telco (Data Lake)

A cloud-native data lake that consolidates multi-source telecom data into a single, trusted Customer 360 view, enabling advanced analytics and subscriber intelligence.

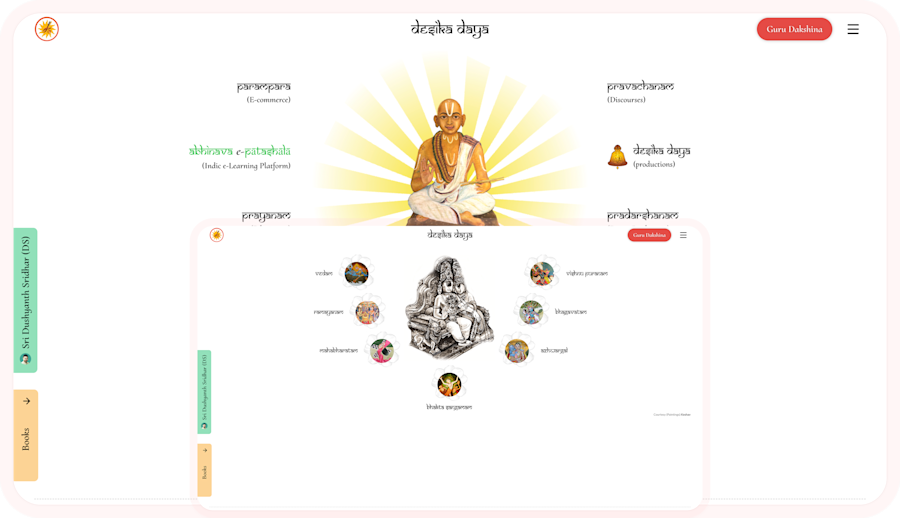

Desikadaya – Integrated Learning & E-Commerce Platform

A visionary digital learning platform that blends e-commerce, event booking, and an expansive educational hub to redefine how knowledge is discovered, accessed, and experienced.

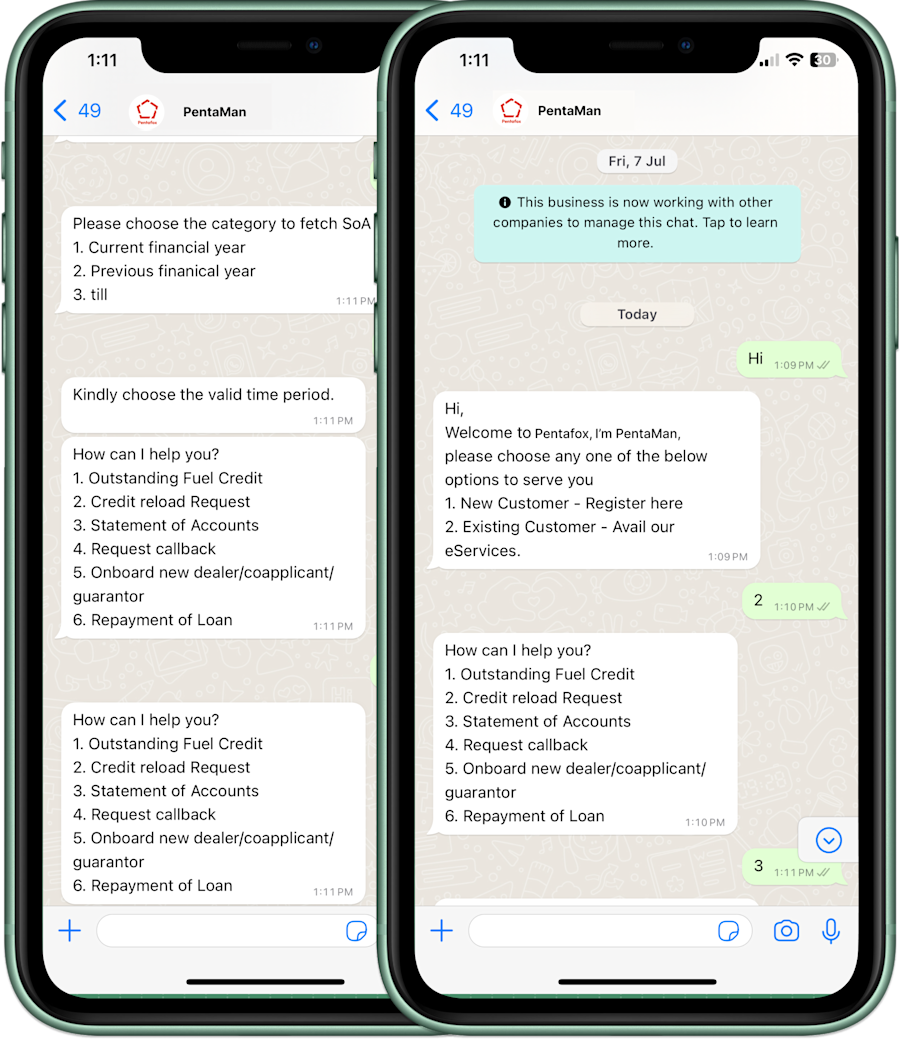

Conversational Assistant with Embedded Intelligence

An AI-powered conversational assistant that enables seamless financial interactions through WhatsApp, combining automation, intelligence, and secure digital banking experiences.

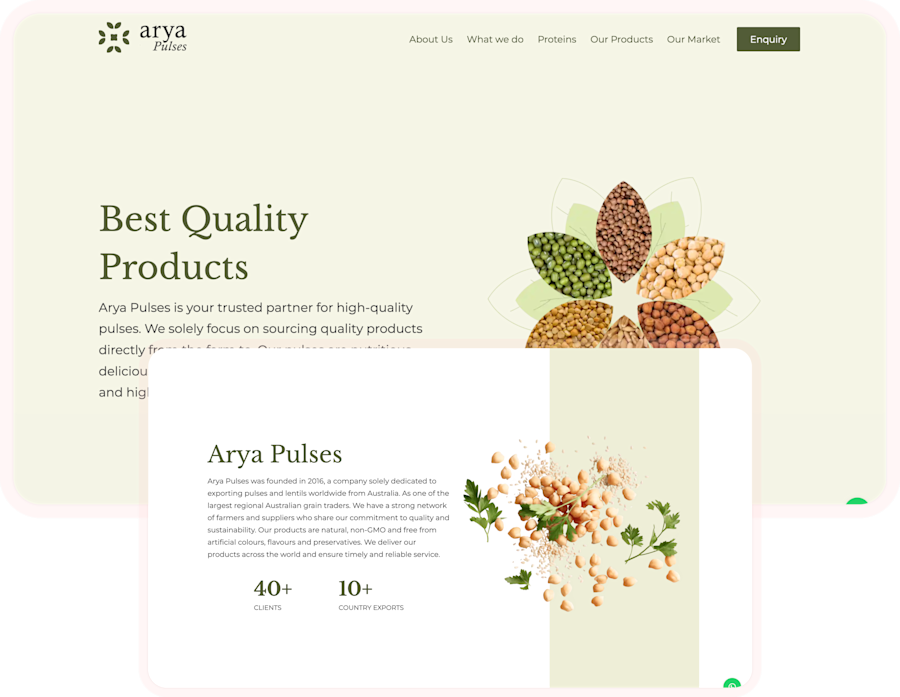

Arya Pulses – Global Pulses Business Website

A professionally crafted business website that reflects Arya Pulses’ commitment to quality and showcases their journey of exporting premium pulses to global markets.

Customer Engagement Suite – MLOps & Analytics Platform

A production-grade MLOps and analytics platform that operationalizes machine learning through continuous deployment, monitoring, and optimization of models for customer insights.

MSSQL to BigQuery – Cloud Data Migration

A cloud data migration initiative that modernized enterprise data platforms by migrating MSSQL data to BigQuery, enabling scalable analytics, improved performance, and simplified data access.

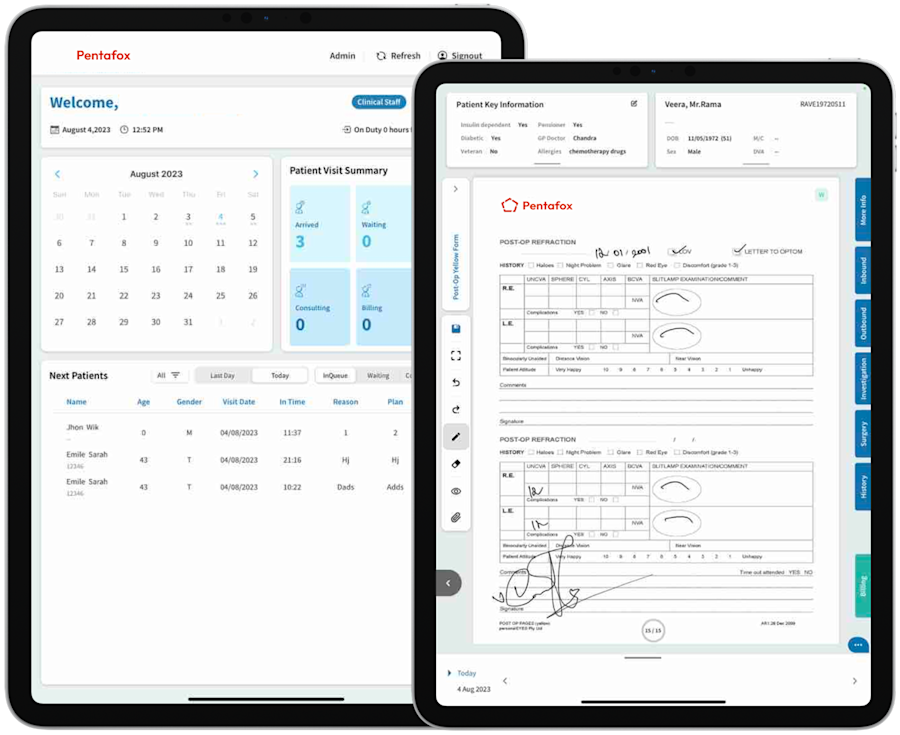

EMR – Electronic Medical Records Platform

A modern Electronic Medical Records (EMR) application designed to digitize and streamline patient data, appointments, prescriptions, and medical history within a secure healthcare environment.

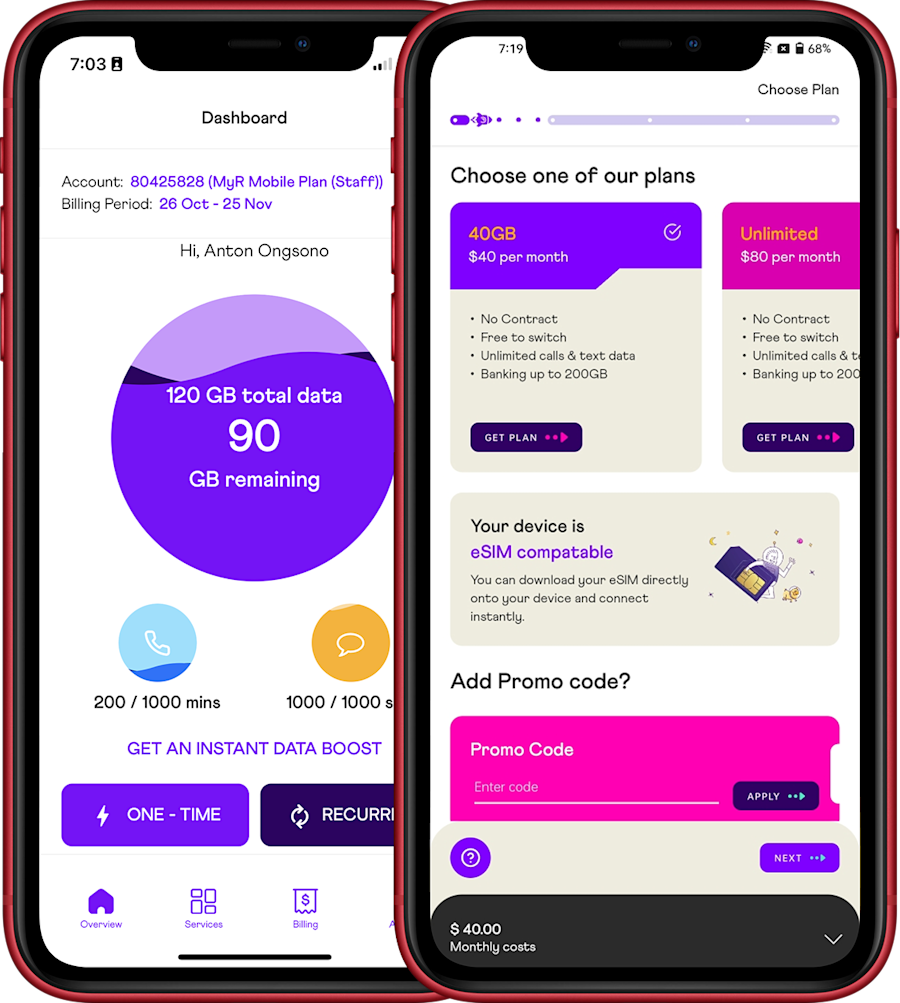

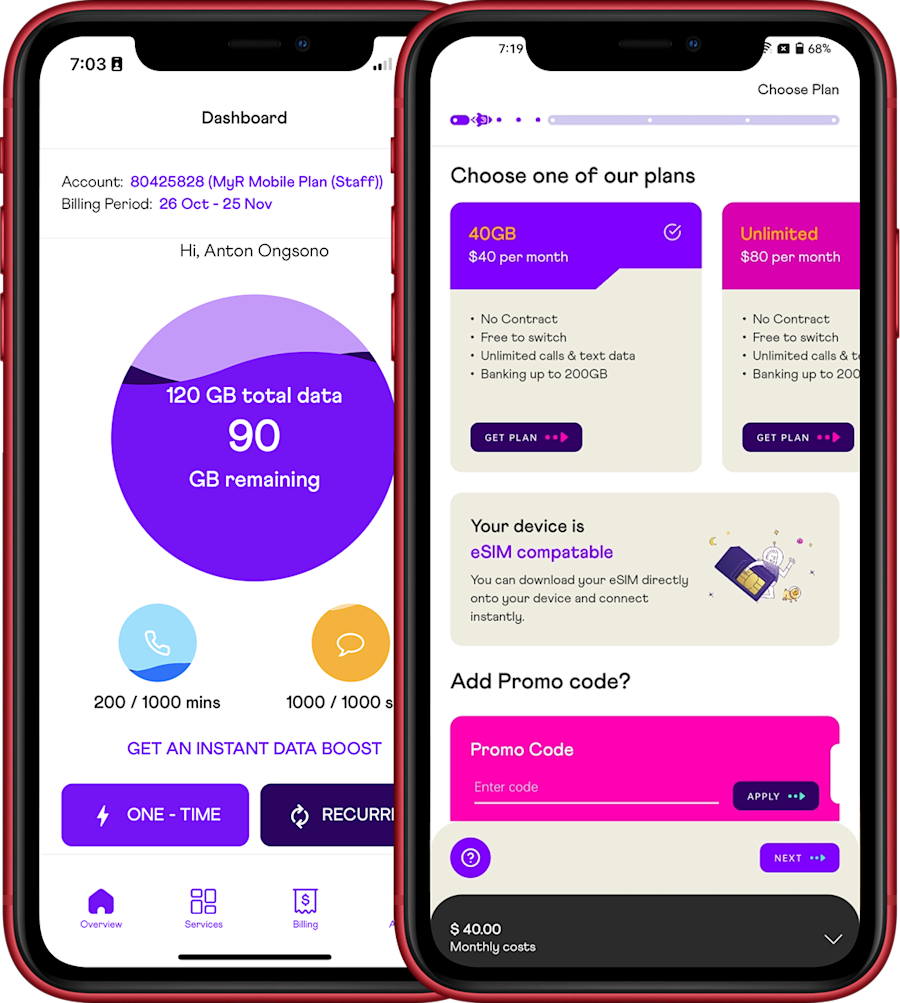

MyRepublic App – Digital Connectivity Experience

A next-generation digital application designed to transform how users manage and experience internet connectivity through a seamless, intuitive, and personalized platform.